In the recent case of Lateesa Ward, TC Memo 2020-32, the Tax Court addressed a regular tax planning and reporting issue – reasonable compensation to an S corporation shareholder. The issue is important for at least a couple of primary reasons. First, as opposed to dividends, wages paid to the S corporation shareholder are subject to self-employment tax.[1] Any additional payments to the shareholder should be free from any employment tax obligation. Second, wages are not eligible for the 20% deduction for qualified business income.[2] Similar to the employment tax consequences, additional payments to the shareholder should qualify for this 20% deduction.[3] As a result, S corporation shareholders are incentivized to maximize the amount they withdraw from their businesses as dividends rather than wages. For many S corporation shareholders, the entire point of operating through an S corporation is to minimize employment taxes by paying dividends which otherwise would be subject to employment tax if operating through a sole proprietorship or partnership.

Facts and Holding – Ward’s Payments as Wages

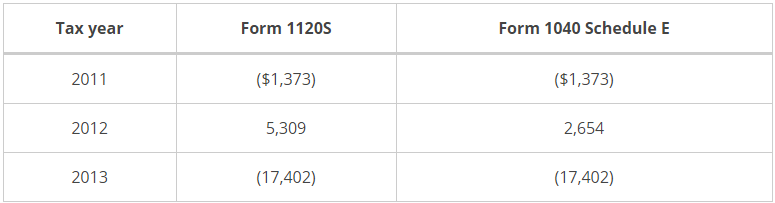

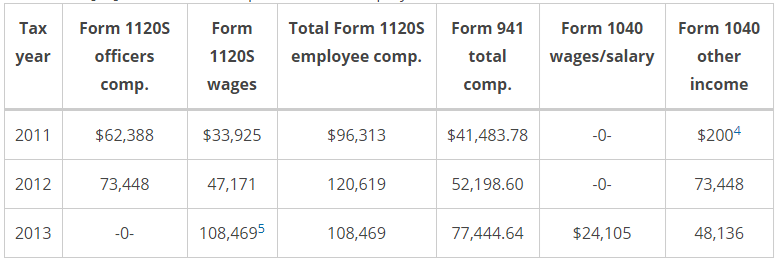

In the Ward case, the taxpayer was the sole owner of a law firm organized as an S corporation. Her tax returns had several errors and inconsistencies. One of the issues involved payments to her as the sole owner and officer of the law firm. See the charts below taken from the Tax Court’s opinion which illustrate tax reporting by the S corporation and Ms. Ward:

From this information, several issues become clear. For 2011, while the S corporation deducted income taken by Ms. Ward, she did not report that compensation as income at all nor was her income reported on a Form 941 for employment tax purposes. For 2012, while Ms. Ward reported her S corporation payments as income on her Form 1040, she did not report any of that income as being subject to employment taxes even though the S corporation deducted those payments as officer compensation. For 2013, the S corporation reported $0 as officer compensation, yet Ms. Ward reported certain income as being subject to employment tax. Clearly, the reporting required some adjustments and was visibly inconsistent.

The IRS argued that, as the sole officer of the S corporation, all payments made to Ms. Ward constituted wages subject to employment tax. None of those payments constituted dividends. There was some dispute over who owed employment taxes, the S corporation or Ms. Ward. Regardless, the Tax Court held that all payments to Ms. Ward constituted wages subject to employment tax. In so holding, the Tax Court stated “the firm offers no evidence other than Ward’s own testimony that any of these payments were anything but compensation.” The Tax Court put the burden on Ms. Ward to prove that payments she received, especially while the sole officer of the S corporation were dividends. Without anything but self-serving testimony, the Tax Court felt she failed to meet this burden.

Discussion

In Ward, the Tax Court failed to recognize that any of the payments from Ms. Ward constituted dividends versus wages. Certainly, there is an obligation to report reasonable compensation as wages. However, beyond that, it also seems reasonable to recognize that part of a business owner’s income, even from a business for which they perform services, is a return of their investment as profits not subject to employment tax, i.e. S corporation dividends. Perhaps due to the troubled tax reporting in this case, the Tax Court, finding that Ms. Ward held the burden of proof, felt compelled to its result.

Various cases in this area have reached differing results. In Radtke[4] (also a wholly owned law firm), the Court of Appeals for the Seventh Circuit affirmed a district court’s recharacterization of all payments to an S corporation shareholder as wages. The district court’s opinion[5] noted the facts of the case as one “where the corporation’s only director had the corporation pay himself, the only significant employee, no salary for substantial services.” As in Ward, for at least some of the years at issue, the sole shareholder and officer reported zero in wages while reporting 100% of payments received as a dividend. In Spicer[6], an accounting firm’s president and only accountant also reported zero in wages and all payments as dividends. Mr. Spicer acknowledged that he provided substantial services to the firm. Citing to Radtke, the Ninth Circuit Court of Appeals found all of Mr. Spicer’s payments as wages subject to employment tax. Both the Radtke and Spicer cases have facts similar to the Ward case, all of which reached a similar result. Other cases have turned out the same.[7]

On the other hand, some taxpayers have been more successful. Watson[8] involved another sole shareholder S corporation. The S corporation owned a 25% interest in a CPA firm. Here, however, Mr. Watson reported some of his payments from the S corporation as wages, $48,000, while reporting the balance, $330,000, as dividends. The IRS did not argue all the payments to Mr. Watson constituted wages. Rather, the IRS engaged an expert to testify that the $48,000 of reported wages was unreasonably understated, that is, $48,000 was not reasonable compensation for someone in Mr. Watson’s position. The Eighth Circuit Court of Appeals noted that the “fact-intensive” analysis of reasonable compensation is “a matter to be determined in view of all the evidence.” In this case, the IRS expert’s opinion was adopted resulting in an adjustment classifying $182,088 as wages. Also, in McAlary[9], the Tax Court noted that the analysis is “dependent on a number of factors.” Mr. McAlary reported zero compensation, but rather all payments as dividends. He “single-handedly conducted” a real estate brokerage firm’s daily business operations. However, again, the IRS put on expert proof of what would have constituted reasonable compensation. The Tax Court did not agree with the expert, but still required Mr. McAlary to report $83,200 out of $185,842 as wages subject to employment tax. This result is supported by IRS statements and additional case law.[10] These authorities all indicate certain factors to be considered in a facts and circumstances analysis of reasonable compensation. Factors may include the taxpayer’s experience, training, duties and responsibilities, time dedicated to the business, payments to non-shareholder employees, comparable pay for similar services, etc.

Conclusion

Many planners advise S corporation shareholders on compensation versus dividend treatment, primarily to determine proper employment tax reporting. The stakes are raised now that the 20% deduction for qualified business income is available under IRC §199A. One can only expect S corporation shareholders to be more aggressive.

From the case law, some basic lessons can be learned. First, it seems clear that having evidence to support the level of compensation paid is reasonable. This evidence may come in many forms including a review of the factors described above. Where contemporaneous documentation, such as S corporation resolution or research data, is compiled, the taxpayer will be at a significant advantage. Where there is no evidence to prove wages versus dividends, it is possible that taxpayers could end up in the situation of Ms. Ward – a total loss. Second, the old saying “pigs get fed; hogs get slaughtered” may hold true in this area. Where S corporations pay their shareholders low, but yet reasonable, compensation, there may be little incentive for the IRS to seek adjustments. Even where adjustments are sought, especially when coupled with evidence supporting the compensation paid, the taxpayer may not see a total loss but merely an adjustment between wages and dividends. This also reduces exposure to penalties and interest. Given the fact intensive nature of these issues, controversies with the IRS can become costly involving fees for accountants, attorneys, and compensation experts. The more that can be done to avoid these costs by early, prudent planning, the better protected a S corporation shareholder should be.

As in many, if not most, areas of tax law, S corporation shareholders seeking to reduce self-employment tax and increase the availability of a 20% qualified business income deduction will seek to reduce wages and increase dividends. For those taxpayers who avoid being greedy and who keep good records supporting their tax positions, there may be little to fear. For taxpayers who engage in blatant misreporting without substantiation, it appears courts may have little sympathy.

[1] See Rev. Rul. 77-44

[2] IRC § 199A(c)(4)(A)

[3] But note that there limits on the ability to take the 20% qualified business income deduction may apply. See IRC § 199A(b)(2)(B)(i). If so, one of the applicable limits is tested in relation to W-2 wages paid by the S corporation. In this instance, there could be a benefit to paying W-2 wages to the S corporation shareholder to the extent the deduction would be otherwise limited.

[4] Radtke v. U.S., 895 F.2d 1196 (7th Cir. 1990)

[5] Radtke v. U.S., 712 F.Supp. 143 (D.C. Wis. 1989)

[6] Spicer Accounting, Inc. v. U.S., 918 F.2d 90 (9th Cir. 1990)

[7] See Veterinary Surgical Consultants, P.C., 117 T.C. 141 (2001); Mike J. Graham Trucking, Inc., TC Memo. 2003-49; Superior Proside, Inc., TC Memo. 2003-50; Specialty Transport & Delivery Services, Inc., TC Memo. 2003-51; Nu-Look Design, Inc., TC Memo. 2003-52; and Water-Pure Systems, Inc., TC Memo. 2003-53.

[8] Watson v. U.S., 668 F.3d 1008 (8th Cir. 2012)

[9] Sean McAlary Ltd, Inc., TC Memo 2013-62; citing Charles Schneider & Co. v. Comm., 500 F.2d 148, 151-152 (8th Cir. 1974); K&K Veterinary Supply, Inc., TC Memo 2013-84; and Joly, TC Memo 1995-361.

[10] See IRS Fact Sheet 2008-25, https://www.irs.gov/pub/irs-news/fs-08-25.pdf, and JD & Assocs., Ltd., 2006 WL 8440376.